Biweekly pay tax calculator

If you make 55000 a year living in the region of New York USA you will be taxed 11959. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432.

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Based on the number of.

. Calculating Your Federal Withholding Tax To calculate your federal withholding tax find your tax status on your W-4 Form. You can calculate your Weekly take home pay based of your Weekly gross income and the tax allowances tax credits. Garnishments Payroll Deferrals eg.

The Canada Weekly Tax Calculator is updated for the 202223 tax year. The result is that the FICA taxes you pay are still only 62 for Social Security. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

If you participate in tax deferred. Once every two weeks Example. In this case you are responsible for ensuring that 100 of your FICA taxes are paid and will likely need to cover the entirety of them yourself.

Based on the number of withholding allowances claimed on your W-4 Form and the amount of wages calculate the amount of taxes to withhold. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. That means that your net pay will be 43041 per year or 3587 per month.

403b 457 Deferred Comp--to calculate the bi-weekly equivalent for these deductions take your current monthly deduction multiplied by 12 then. Also a bi-weekly payment frequency generates. That means that your net pay will be 40568 per year or 3381 per month.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. Computes federal and state tax withholding for. Your average tax rate is.

Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be. Your average tax rate is. Your average tax rate is.

Bi-weekly and semi-monthly are the most common methods to pay for hours worked. How Your Tennessee Paycheck Works While your employer typically covers 50 of your FICA taxes this is not the case if you are a self-employed worker or an independent contractor. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks.

For the purposes of this calculator bi-weekly payments occur every other week though in some cases it can be used to mean twice a week. That means that your net pay will be 37957 per year or 3163 per month.

Free 6 Sample Net Pay Calculator Templates In Pdf Excel

Free Online Paycheck Calculator Calculate Take Home Pay 2022

The Pros And Cons Biweekly Vs Semimonthly Payroll

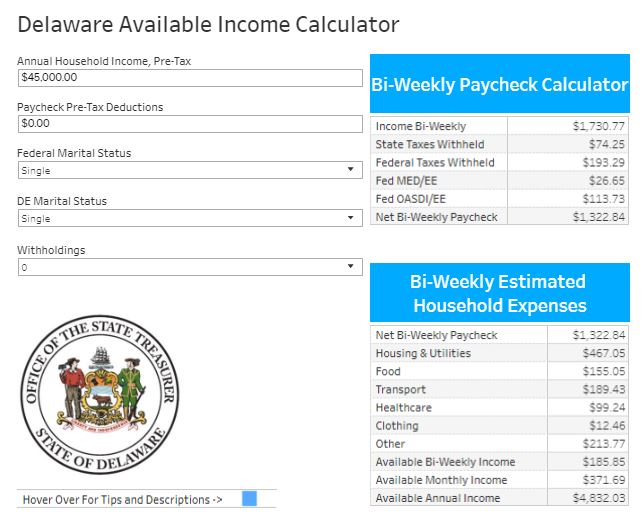

Delaware Available Income Calculator State Treasurer Colleen C Davis State Of Delaware

Paycheck Calculator Take Home Pay Calculator

Tips For Parents Earning A Minimum Wage Salary Going Back To School Canadian Budget Binder

Paycheck Calculator Template Download Printable Pdf Templateroller

Paycheck Calculator Take Home Pay Calculator

How To Calculate Federal Income Tax

Calculation Of Federal Employment Taxes Payroll Services

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

Calculation Of Federal Employment Taxes Payroll Services

Hourly Wage To Biweekly Paycheck Converter Hourly Salary Conversion Calculator

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Mathematics For Work And Everyday Life

How To Calculate Payroll Taxes Methods Examples More

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto